Disclaimer: This is general advice for static caravan buyers. Some details may not apply to our park, so please check with our team before making any decisions.

An essential guide for those interested in buying a static caravan holiday home in Shropshire.

Key Facts: Static Caravan & Lodge Insurance at a Glance

| Question |

Short Answer |

| Is insurance legally required? |

No. But most parks require it in your pitch licence. |

| Does it cover storms? |

Yes. In most standard policies. |

| Are contents insured? |

Often optional. Check your policy. |

| Is liability included? |

Usually. Limits vary (often £2m–£5m). |

| Can I insure older vans? |

Yes. But premiums may be higher and cover more limited. |

| What if I let it out? |

Special cover needed. You need a policy that clearly allows holiday letting. |

| Can I use any insurer? |

Typically yes. Unless the park sets specific rules. |

Ads by Salop Caravan Sites

Scroll to continue with content

Quick Takeaways

- What static caravan insurance does and doesn't cover.

- How cover works on holiday parks.

- What affects cost, including flood and storm risk.

- How to compare providers and policy types.

- What happens when you claim, including drain-down rules.

- Key trends, checklist and FAQs for sanity-checking your policy.

What This Guide Covers

- What static caravan insurance covers

- Cover differences between static caravans & lodges

- What drives the cost of insurance

- Static caravan insurance providers & policy types

- What happens when you make a claim

- Insurance trends affecting owners

- Checklist and FAQs

1. Your Static Caravan & Lodge Insurance Safety Net

The pitch is perfect. The lake view sealed the deal.

Now there's just one box left to tick. Insurance.

It's not the exciting part — but it's the part that lets you enjoy everything else without a second thought.

This guide cuts through the jargon and gives you the honest picture: what's covered, what isn't, and how to avoid the mistakes that trip up first-time buyers.

Whether you're looking at Spring Lea near Shrewsbury or elsewhere in Shropshire, when something goes wrong, you want:

- Clear cover

- One obvious point of contact

- No nasty surprises in the small print

Insurance sits alongside your pitch licence and your site fees. Most parks across the UK expect all three to be in place if you want to keep your unit on their land.

2. Understanding Static Caravan & Lodge Insurance

How this type of insurance works

Static caravan and lodge insurance is a specialist policy for holiday homes on parks.

You pay a premium (yearly or monthly). In return, the insurer agrees to cover certain types of loss up to set limits, as long as you follow the conditions in the policy.

Two main settlement types:

New for Old

If your caravan or lodge is written off, the insurer pays to replace it with a new equivalent model, within age and value limits.

Market Value

The insurer pays what the unit was worth at the time of loss, taking age and wear into account.

New for Old gives more predictable protection but costs more.

Market Value is cheaper but can leave a gap between the payout and the cost of a replacement.

Is it a legal requirement?

No. There is no law that says you must insure a static caravan or lodge.

But in practice:

- Most parks write an insurance requirement into the pitch licence.

- Lenders will almost always insist on cover if you have finance on the unit.

So, insurance is usually a condition of ownership on UK holiday parks, even if it isn't a legal requirement like car insurance.

How it differs from other insurance

Home insurance

Designed for bricks-and-mortar main homes. Not suitable for park-based static caravans.

Touring caravan insurance

Designed for vans that move on the road. Not suitable for permanently sited units.

Static caravan / lodge insurance

Designed for units that stay on one pitch. Covers park-based holiday home risks and long unoccupied periods.

This is the correct type for caravans and lodges on holiday parks.

3. Static Caravan vs Holiday Lodge Insurance

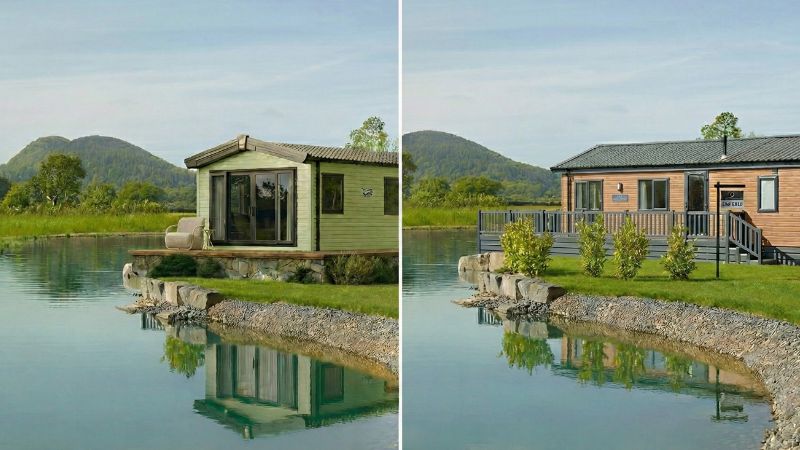

Lodges (right) often require higher sums insured due to construction methods and extensive decking.

Often, insurers bundle both under "holiday home" or "leisure home" cover. But there are some differences in practice.

Higher values for lodges

Holiday lodges usually cost more to buy, sit on more substantial bases and decking, and include higher-spec fixtures and fittings.

That means higher sums insured – sometimes hundreds of thousands of pounds once you include the structure, decking and landscaping.

New for Old limits

Insurers often offer New for Old on lodges for longer (for example up to 20–25 years).

They often cap static caravan New for Old at a lower age (often around 10–15 years), because lodges tend to hold their value better and are built to higher standards.

Construction differences

Lodges built to BS3632 residential spec are usually better insulated, heavier and more robust, and closer to small timber-frame houses than lighter holiday vans.

That can feed into how insurers view storm and frost risk.

You don't usually need a completely different type of policy.

You simply need to tell the insurer clearly whether it's a static caravan or a lodge, and set the sum insured at a realistic replacement level.

4. What Static Caravan & Lodge Insurance Typically Covers

Weather damage

Most comprehensive policies include cover for:

- Storm and wind damage

- Flooding (rivers, sea or surface water, depending on wording)

- Fire and smoke

- Lightning and explosion

Check for: Higher premiums or excesses in known flood zones, and conditions around winter damage – minimum heating or drain-down in the closed season.

Theft and vandalism

Standard cover usually includes theft, attempted theft, malicious damage and vandalism.

Insurers will normally expect a police crime reference number and evidence of forced entry or damage.

Public liability

Public liability protects you if someone is injured at your caravan or lodge, or has their property damaged in connection with your unit.

Parks often require £2 million to £5 million of public liability cover.

If friends, family or paying guests use the unit, this is essential.

Optional add-ons

- Contents: your belongings, furniture, soft furnishings and small appliances.

- Alternative accommodation: somewhere else to stay if your unit becomes uninhabitable after an insured event.

- Loss of rent / booking income: if you let the unit and have to cancel bookings.

- Resiting and site clearance: removing a written-off unit and positioning a replacement.

- Legal expenses: for certain legal disputes related to the unit or its use.

5. What Affects the Cost in 2026?

Location and flood risk

Risk (and price) changes by location:

- Coastal parks: more exposed to wind and, in some cases, coastal flooding.

- Riverside or low-lying parks: higher general flood risk.

- Inland, secure parks: often lower risk overall.

Rising flood and storm claims across the UK feed directly into premiums.

Age and condition of the unit

Older units are more likely to suffer wear-and-tear, can be harder to repair, and may not qualify for New for Old beyond a certain age.

Some insurers stop offering New for Old at a specific age and only offer Market Value beyond that.

How you use your caravan or lodge

- Owner and family only: standard pricing.

- Friends and extended family: often still fine on standard cover.

- Paying guests / holiday lets: you need a policy that clearly allows holiday letting.

If you let the unit and don't declare it, you risk guest-related damage not being covered and loss of rent claims being declined.

Be honest at quote stage.

Security and park setup

Security that helps includes gated entry, CCTV, on-site wardens, and good locks/alarms.

Tell your insurer what the park has. They can't reflect reduced risk in the price if they don't know.

Typical costs in 2026

There's no single "right" price.

Broadly, many static caravan owners see £130–£150 per year for structure-only cover in average-risk locations.

Lodges, high-value units, higher-risk sites and extras like contents or loss of rent push the cost up.

6. How the Claims Process Works

Common claim scenarios

- Storm damage to roofs, cladding or windows

- Flooding after heavy rain or river events

- Burst pipes and escape of water over winter

- Theft and vandalism when the park is quiet

- Accidental damage to fixtures and fittings

- Occasional public liability claims after injuries

The "drain down" trap

Winter beauty brings freezing risks. Always follow your drain-down requirements.

This catches a lot of owners out.

Most policies say that during the closed season you must drain down the water system and/or follow manufacturer or park winterisation instructions.

If you leave water in the pipes and it freezes, pipes can burst and floors can be soaked.

Insurers often treat this as preventable, not an insured event, if you've ignored clear winterisation conditions.

If your park offers a drain-down service, it's usually money well spent.

What to do when something happens

- Stay safe: don't enter if there's a risk from electrics, gas or structure.

- Limit further damage: turn off water and gas if it's safe to do so.

- Take photos: before you clean up or move too much.

- Tell the park: so they know what's happened and can help secure the area.

- Call your insurer: use the claims or emergency number and follow their guidance.

7. Choosing Providers and Policies

Types of provider

Specialist holiday home insurers or brokers: Focus on static caravans, lodges and park homes, and understand park rules and closed seasons. (e.g., Leisuredays, Caravan Guard, Towergate, Intasure).

Park-linked schemes: The park works with a particular provider. Convenient and often smooth on claims.

General insurers / comparison sites: Offer broader "holiday home" products. Can be good value, but read the wording carefully.

New for Old vs Market Value

New for Old: Aims to replace your caravan with a new equivalent model. More expensive, but more predictable.

Market Value: Pays what the unit was worth at the time of loss. Cheaper, but often not enough to buy an equivalent replacement.

Park rules and minimum cover

Always check your pitch licence for minimum public liability levels and required perils.

If a park charges a small admin fee to check outside policies, that's common.

If they say you have no choice except one provider, ask politely to see that in writing.

8. 2026 Trends in Static Caravan & Lodge Insurance

Climate and weather impact

Insurers are paying out more for flood and storm claims across the UK.

Expect higher premiums in exposed areas and closer scrutiny of flood history.

Digital-first and app-based insurance

You're more likely to see online-only quote journeys and policy management.

You spend less time on the phone, but you need to be comfortable self-serving online.

Modular "build your own" cover

More insurers now let you start with structure + liability, then add contents, accidental damage, loss of rent and legal expenses if you need them.

9. Final Checklist Before You Buy

Use this checklist before you commit to a static caravan or lodge insurance policy:

- ☐ Specs: make, model, year, size and serial/chassis number are correct.

- ☐ Sum insured: the amount would actually cover a realistic replacement, including decking if needed.

- ☐ Park rules: liability limits and core cover meet your pitch licence requirements.

- ☐ Winter rules: you understand the drain-down and unoccupancy conditions and can follow them.

- ☐ Cover type: you know if it is New for Old or Market Value – and you are comfortable with that trade-off.

- ☐ Excesses: you have checked the excesses for storm, flood, escape of water and accidental damage.

- ☐ Usage: the policy clearly allows the way you actually use the unit (family only or holiday letting).

- ☐ Extras: you have made a conscious decision on contents, loss of rent and alternative accommodation.

10. Frequently Asked Questions

How much does static caravan insurance typically cost?

For structure-only cover in average-risk areas, many owners pay around £130–£150 per year. Lodges, higher sums insured, higher-risk locations and extras like contents and loss of rent increase the cost.

Is static caravan insurance a legal requirement?

No. But most parks and finance providers treat it as a condition of ownership, so going without isn't realistic.

Do I need different cover if I let my caravan or lodge out?

Yes. You need a policy that clearly allows holiday letting or paying guests, and ideally includes loss-of-rent cover if bookings are important to you.

What happens if I don't drain down in winter?

If your policy requires drain-down or other winterisation and you don't do it, frost damage to pipes and water systems is often excluded. It's one of the most common reasons winter claims are rejected.

Does insurance cover my decking and verandah?

Often yes, but only if you include the value of decking and other structures in your overall sum insured. If you leave them out, you risk being under-insured.

Can I choose my own insurer instead of the park's recommended provider?

On many parks, yes – as long as your policy meets their requirements. Some parks run their own schemes. If they say you must use one provider only, ask for that in writing and check whether matching cover elsewhere is allowed.

Can I have a hot tub at Spring Lea?

Yes — hot tubs are permitted on owner pitches, subject to park guidelines. If you're adding a hot tub, make sure your insurance policy covers external fixtures.

11. Conclusion: Confident, Protected Ownership

With the right cover in place, you can focus on the things that matter — like these views.

Nobody buys a holiday home for the paperwork. But getting the insurance right means the paperwork stops there.

No surprises when something goes wrong. No arguments about what's covered. Just peace of mind.

Sort it once. Review it yearly. Then forget about it and enjoy the view.

The lake, the hot tub, the weekends you actually came here for — that's what matters.

Why Buy at Spring Lea?

Spring Lea is a brand-new countryside holiday park and fishery in the heart of Shropshire, designed for owners who want peaceful escapes with exceptional fishing on their doorstep.

- Competitive Fees: Site fees from just £3,762/year (single) or £4,377 (double)

- Inland, Sheltered Location: Protected from coastal weather extremes — often means lower wind-related insurance claims

- Well-Drained Park: Established drainage reduces surface water flood risk

- Secure, Owners-Only: Quieter parks often benefit from lower theft and vandalism risk

- Fishing Paradise: Four coarse and carp lakes with fish up to 36lbs

- Watersports: Paddleboarding and kayaking on Lake Kingfisher (BYO equipment)

- Hot Tubs Allowed: Subject to park approval — just ensure your insurer knows

- Included Extras: Piped gas and wired broadband as standard on all pitches

- Family Friendly: Children's play area plus enclosed dog walking area

- On-Site Support: Managed by Martin & Ann Phillips, who can guide you through winterisation and maintenance

Ready to find out more? Book a VIP park tour at Spring Lea and see why owners love it here.

Spring Lea at a Glance

| Location |

Lea Cross, 5 miles from Shrewsbury |

| Postcode |

SY5 8HU |

| Park Managers |

Martin & Ann Phillips |

| Season |

10+ months |

| Site Fees (inc VAT) |

Single £3,762 / Double £4,377 |

| On-Site Facilities |

4 fishing lakes, paddleboarding/kayaking, children's play area, dog exercise area, piped gas, wired broadband, free Wi-Fi |

| Hot Tubs |

Allowed (subject to park approval) |

| Pets |

Welcome, with enclosed dog walking area |

Disclaimer: This guide is for general information only and reflects typical industry practice as of 2025/2026. While we aim for accuracy, we make no representations or warranties about the completeness, accuracy, or reliability of the information provided, and we accept no liability for any errors or omissions. Costs, policies, licence terms, and facilities vary between parks and manufacturers and may change without notice. Any reliance you place on this information is at your own risk — always confirm details directly with the park manager before making any purchase decision. This content does not constitute financial, legal, or professional advice. If you need specific guidance, please consult a qualified professional.